Does Insurance Cover Tooth Bonding?

When contemplating tooth bonding to improve your smile, you may question whether your insurance will cover the cost. It’s crucial to highlight that coverage can differ significantly depending on your individual dental plan. Generally, insurance may include tooth bonding if it’s considered medically essential, but not if it’s solely for aesthetic purposes. You’ll have to review the specifics of your plan, including any provisions regarding cosmetic treatments.

Could your policy provide more extensive coverage, or are there alternative solutions to handle the expenses? Let’s delve into what you must understand to navigate these waters proficiently.

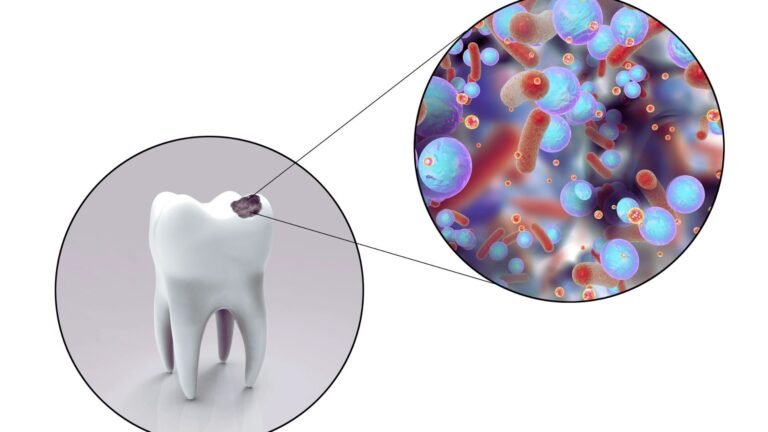

Understanding Tooth Bonding

Tooth bonding is a cosmetic dental procedure where a dentist applies a tooth-colored resin to repair or enhance your smile. The bonding process involves roughening the surface of your tooth, applying a conditioning liquid, and then placing the resin. Your dentist molds the resin to the desired shape and hardens it with a special light. This method can seamlessly cover discolorations, fill gaps, or change a tooth’s shape, offering immediate benefits by improving the appearance of your teeth and boosting your confidence.

You’ll find that the cost factors for tooth bonding are relatively favorable compared to other cosmetic dental procedures like veneers or crowns. Typically, the price depends on the extent of the work needed and the number of teeth involved. Although bonding is less expensive, it’s important to take into account its longevity. Proper maintenance can extend its life; this includes avoiding hard foods, biting nails, or using your teeth to open packaging.

Regular brushing, flossing, and dental check-ups are vital to maintain the integrity and appearance of the bonding material. By taking good care of your bonded teeth, you can enjoy a beautiful smile for several years.

Insurance Coverage Criteria

While considering the costs and care for tooth bonding, it’s also important to explore how insurance policies handle coverage for this procedure. As you look into whether your dental insurance might cover tooth bonding, you’ll find that coverage often hinges on specific eligibility requirements and coverage limitations.

Eligibility requirements typically include the necessity of the procedure; for instance, whether the bonding is considered cosmetic or is essential for the health of your teeth. Coverage limitations, on the other hand, might relate to the number of teeth that can be treated or the frequency of treatments covered within a certain period.

To give you a clearer picture, here’s a summary table:

| Criteria | Description | Example |

|---|---|---|

| Eligibility | Determines if the procedure is necessary for health or cosmetic. | Only covers if it’s to restore tooth function. |

| Coverage Limitations | Specifies limits on the number of treatments or teeth. | Covers up to 2 teeth per year. |

| Pre-approval Required | Indicates if prior approval from the insurance is needed. | Pre-approval needed for procedures over $500. |

| Frequency of Coverage | How often you can receive treatment under your plan. | Coverage is provided once every two years. |

Understanding these factors can help you navigate your dental insurance effectively and set realistic expectations regarding out-of-pocket costs.

Comparing Dental Insurance Plans

When comparing dental insurance plans, it’s essential to assess their coverage specifics for procedures like tooth bonding to ensure they meet your needs. Each plan varies considerably, not only in the types of procedures covered but also in the extent of that coverage. You’ll find that some plans may cover tooth bonding under certain conditions, such as for structural repair, while excluding it for aesthetic purposes. This is where understanding the coverage limitations becomes vital.

To effectively compare costs, look at both the premiums and the out-of-pocket expenses you’re expected to pay. Some plans might offer lower monthly premiums but could impose higher deductibles or co-payments for procedures like tooth bonding. Additionally, check if there’s a cap on how much you can claim for dental care annually—this can greatly impact your overall cost if you require multiple treatments.

It’s also wise to review the list of in-network dentists as using an out-of-network dentist can significantly increase your out-of-pocket expenses.

Tips for Maximizing Coverage

You can optimize your dental insurance coverage for tooth bonding by understanding and utilizing a few strategic tips. First, it’s important to know your coverage limits. Many plans have a cap on how much they’ll pay for cosmetic procedures, including tooth bonding, per year. Check these limits to make sure you’re not out of pocket for unexpected costs.

Next, familiarize yourself with the claim process. Submitting claims correctly and on time can make a significant difference in how much of your treatment is covered.

Here’s a quick guide to help you navigate this process:

| Tip | Detail | How It Helps |

|---|---|---|

| Understand Your Policy | Review your insurance policy’s details on cosmetic dentistry. | Ensures you know what’s covered and to what extent. |

| Pre-Authorization | Obtain pre-authorization for procedures when required. | Prevents disputes about coverage eligibility. |

| Submit Claims Promptly | Submit claims right after the procedure. | Avoids delays in reimbursement. |

| Keep Documentation | Keep detailed records and receipts related to your treatment. | Supports your claim in case of disputes. |

| Annual Max Usage | Plan treatments to maximize use of your annual maximum benefit. | Helps in budgeting and avoids wastage of benefits. |

Alternative Financing Options

If your insurance doesn’t fully cover tooth bonding, consider exploring alternative financing options to manage the costs effectively.

Many dental offices offer payment plans that allow you to spread the expense over several months, making it easier on your budget. These plans often require an initial down payment followed by monthly installments. It’s important to inquire about the interest rates and any potential fees associated with these plans to confirm they’re a viable option for you.

Another avenue to explore is taking out personal loans. Banks and credit unions provide personal loans at competitive interest rates, especially if you have a good credit score. These loans can be tailored to fit your financial situation, offering flexibility regarding repayment terms.

Before deciding on a personal loan, it’s wise to shop around and compare offers from multiple lenders to find the best terms and rates.

Frequently Asked Questions

Can Tooth Bonding Correct All Types of Dental Flaws?

Tooth bonding can’t fix all dental flaws; it has limitations. For significant issues, you’ll need alternative treatments like veneers or crowns. Always consult with your dentist to choose the best option for you.

How Long Does a Tooth Bonding Procedure Take?

Tooth bonding duration typically ranges from 30 to 60 minutes per tooth. If you’re considering alternatives, veneers or crowns might be options, depending on your specific dental needs and desired outcomes.

Is the Tooth Bonding Process Painful?

Tooth bonding typically involves minimal discomfort. Dentists prioritize pain management and patient comfort, using local anesthesia if necessary to guarantee you’re as comfortable as possible during the procedure. It’s generally a pain-free experience.

Are There Any Dietary Restrictions After Tooth Bonding?

After tooth bonding, you’ll need to follow a post-bonding diet. Avoid hard, crunchy, or sticky foods to prevent damage. Eating restrictions are temporary, ensuring your bonding sets properly for lasting results.

How Often Does Tooth Bonding Need to Be Replaced?

Tooth bonding’s lifespan varies, but typically, you’ll need replacement every 5 to 10 years. Factors like oral habits and diet can affect this frequency, so regular dental check-ups are essential for maintenance.

Conclusion

So, to keep your smile bright without breaking the bank, it’s important you understand your dental insurance’s specifics.

Check if tooth bonding is covered, particularly if it’s considered necessary rather than cosmetic.

Always compare plans to find the best coverage and consider pre-approvals to avoid surprises.

If your insurance falls short, don’t worry—look into alternative financing options.

By staying informed and proactive, you can manage the costs of tooth bonding effectively.